Planning a trip? Learn all about travel insurance – what it covers, how much it costs, and why it’s worth it. Find the perfect plan for your 2025 adventures at travelfinancehub.com!

Introduction: Why Travel Insurance Matters

When planning a trip—whether it’s a weekend getaway or a months-long international adventure—few things are as crucial as travel insurance. It’s not just an extra expense; it’s a safety net that ensures peace of mind when the unexpected happens. Lost luggage, canceled flights, medical emergencies, or natural disasters can turn a dream vacation into a nightmare. That’s where travel insurance steps in, offering protection tailored to your needs. At travelfinancehub.com, we’re here to break down why travel insurance is a must-have, how it works, and how to choose the right plan for your next journey.

In this guide, we’ll explore the essentials of travel insurance, its benefits, and practical tips to make informed decisions. By the end, you’ll understand why millions of travelers rely on this financial tool to safeguard their trips in 2025 and beyond.

Whether you’re plotting a short escape or a global journey, travel insurance transforms how you travel. It’s not just an extra fee—it’s your defense against life’s surprises. From misplaced bags to grounded flights or sudden health crises, disruptions can upend any itinerary. That’s why travel insurance is vital, delivering customized coverage for all explorers. At travelfinancehub.com, we’ll unpack its necessity, mechanics, and how to select the ideal policy for your upcoming adventure. This guide dives into the core of travel insurance, its advantages, and handy advice to ensure you’re covered. By the finish, you’ll understand its critical role for 2025 travels.

What Is Travel Insurance?

Travel insurance is a policy designed to cover financial losses or emergencies that may occur before or during your trip. It’s a broad term encompassing various types of coverage, such as trip cancellation, medical expenses, lost baggage, and even evacuation in extreme cases. Unlike regular health or auto insurance, travel insurance is uniquely tailored to the unpredictability of travel.

For instance, imagine you’re stranded in a foreign country due to a sudden illness. Without travel insurance, you could face exorbitant medical bills or logistical nightmares. A good policy ensures you’re not left footing the bill or scrambling for solutions alone.

Travel insurance is a policy that covers financial losses or emergencies tied to travel. It includes protection for trip cancellations, medical issues, lost baggage, and more. Unlike standard insurance, it’s built for travel’s unique risks. Picture yourself sick in a foreign country—without travel insurance, you’d face hefty bills. A solid policy keeps you covered and stress-free.

Key Benefits of Travel Insurance

Why should you invest in travel insurance? The benefits go beyond just covering costs—they provide security and flexibility. Here are the top reasons travelers turn to it:

1. Trip Cancellation and Interruption Coverage

Life is unpredictable. If you need to cancel your trip due to illness, a family emergency, or unforeseen events like a hurricane, travel insurance can reimburse non-refundable expenses like flights, hotels, or tours. Similarly, if your trip is cut short, it can cover the cost of getting home.

2. Medical Emergencies Abroad

Your domestic health insurance might not work overseas. Travel insurance often includes medical coverage for hospital stays, doctor visits, or emergency evacuations—crucial when you’re far from home.

3. Lost or Delayed Baggage

Airlines occasionally lose luggage or delay its arrival. Travel insurance compensates you for essentials like clothing or toiletries while you wait, or for replacing lost items entirely.

4. Travel Delays

Missed connections or canceled flights can derail your plans. Many travel insurance policies cover additional expenses like meals or accommodations caused by delays beyond your control.

5. Peace of Mind

Perhaps the greatest benefit is intangible: knowing you’re protected no matter what happens. Travel insurance lets you focus on enjoying your trip instead of worrying about “what ifs.”

Types of Travel Insurance Plans

Not all travel insurance is the same. Depending on your needs, you can choose from several options. Here’s a breakdown of the most common types:

Single-Trip Travel Insurance

Perfect for one-off vacations, this covers a specific trip from start to finish. It’s ideal if you don’t travel often but want protection for a particular journey.

Annual Travel Insurance

Frequent travelers love this option. Annual travel insurance covers multiple trips within a year, saving time and money if you’re always on the go.

Medical Travel Insurance

Focused solely on health-related issues, this is a must for international trips where your regular insurance doesn’t apply. It’s especially popular with seniors or those with pre-existing conditions.

Comprehensive Travel Insurance

The all-in-one solution, comprehensive plans bundle trip cancellation, medical coverage, baggage loss, and more. It’s the most popular choice for travelers seeking full protection.

Adventure Travel Insurance

For thrill-seekers—think skiing, scuba diving, or hiking—this specialized coverage includes high-risk activities often excluded from standard policies.

How Much Does Travel Insurance Cost?

The cost of travel insurance varies based on factors like trip duration, destination, age, and coverage level. On average, expect to pay 4-10% of your total trip cost. For a $5,000 vacation, that’s $200-$500—a small price for security.

For example, a week-long trip to Europe might cost $100 for basic travel insurance, while an annual plan for frequent travelers could range from $300-$600. To keep costs down, compare quotes online at travelfinancehub.com and tailor your plan to your specific needs.

How to Choose the Best Travel Insurance

With so many options, picking the right travel insurance can feel overwhelming. Follow these steps to find a policy that fits:

1. Assess Your Needs

Are you traveling internationally? Do you have health concerns? Are you booking expensive, non-refundable plans? Your answers determine the coverage you need.

2. Compare Coverage Options

Look beyond price. Check what’s included—medical limits, cancellation policies, or baggage compensation—and what’s excluded, like pre-existing conditions or risky activities.

3. Read Reviews

Research providers for reliability and customer service. A cheap plan isn’t worth it if claims are a hassle to process.

4. Check for Flexibility

Some travel insurance plans allow adjustments if your itinerary changes. Flexibility is key in 2025’s ever-shifting travel landscape.

5. Buy Early

Purchase travel insurance soon after booking your trip to maximize coverage, especially for cancellation benefits. Wikipedia

Common Misconceptions About Travel Insurance

Despite its value, myths about travel insurance persist. Let’s debunk a few:

“I Don’t Need It for Short Trips”

Even a weekend getaway can go wrong—think canceled flights or sudden illness. Travel insurance is worth it regardless of trip length.

“My Credit Card Covers Me”

Some credit cards offer travel perks, but they’re often limited compared to dedicated travel insurance. Check the fine print.

“It’s Too Expensive”

With plans starting as low as $20 for basic coverage, travel insurance is more affordable than most assume.

“It Covers Everything”

Not quite. Policies have exclusions—read yours carefully to avoid surprises.

Travel Insurance in 2025: Trends to Watch

As travel evolves, so does travel insurance. In 2025, expect these trends:

- Pandemic Coverage: Post-COVID, many plans now include cancellation or medical coverage for epidemics.

- Digital Claims: Filing claims online or via apps is becoming standard, speeding up reimbursements.

- Sustainability Focus: Some insurers offer eco-friendly options, offsetting carbon emissions from your trip.

- Customizable Plans: More providers let you pick and choose coverage, ensuring you only pay for what you need.

Stay ahead by exploring these innovations at travelfinancehub.com.

Real-Life Examples: When Travel Insurance Saves the Day

Still unsure if travel insurance is worth it? Consider these scenarios:

- Sarah’s Story: Sarah booked a $3,000 cruise, but a family emergency forced her to cancel. Her travel insurance refunded the full amount.

- Mark’s Mishap: Mark broke his leg skiing in the Alps. His travel insurance covered $15,000 in medical bills and a flight home.

- Lena’s Luggage: Lena’s bag was lost on a flight to Asia. Travel insurance paid for new clothes and essentials within 24 hours.

These cases show how travel insurance turns disasters into manageable hiccups.

Tips for Filing a Travel Insurance Claim

If you need to use your policy, follow these steps for a smooth process:

- Document Everything: Keep receipts, medical records, or delay notices.

- Contact Your Provider ASAP: Report issues promptly to start the claim.

- Be Honest: Provide accurate details to avoid delays or denials.

- Follow Up: Track your claim’s progress and respond to requests quickly.

Where to Buy Travel Insurance

You can purchase travel insurance from:

- Insurance Companies: Big names like Allianz or World Nomads offer robust plans.

- Travel Agencies: Many bundle insurance with bookings.

- Online Comparison Sites: Platforms like travelfinancehub.com let you compare quotes in minutes.

Always verify the provider’s reputation before buying.

Conclusion: Secure Your Next Trip with Travel Insurance

Travel insurance isn’t just a precaution—it’s a smart financial move that protects your wallet and well-being. Whether you’re jetting off to Paris, hiking in Patagonia, or relaxing on a beach, the right policy ensures you’re ready for anything. At travelfinancehub.com, we’re committed to helping you find affordable, reliable travel insurance that fits your budget and travel style.

Don’t leave home without it. Start exploring your options today and travel with confidence in 2025!

You can see this also:

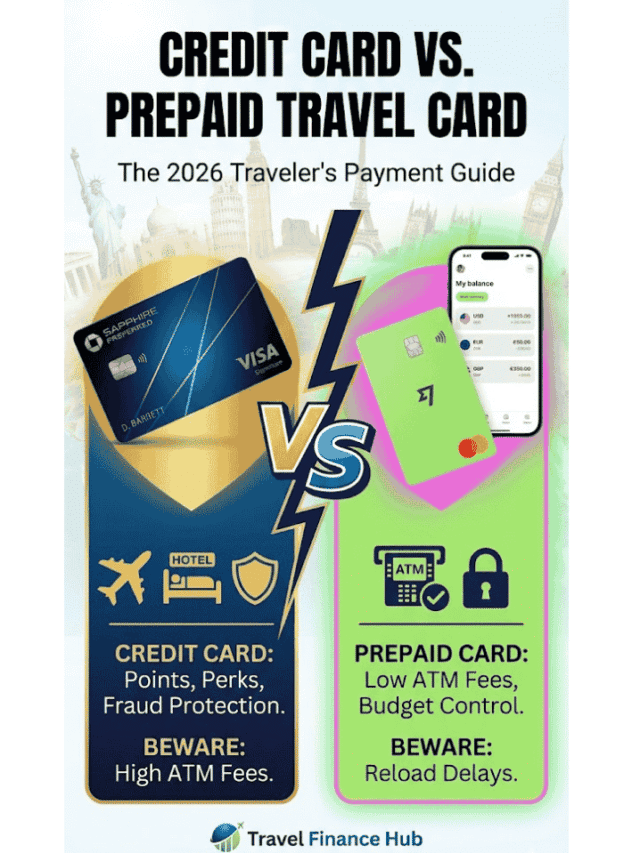

- Credit Card vs Prepaid Travel Card: What’s the Best Way to Pay Abroad in 2026?

- The End of Cheap Japan? Tourist Tax ‘Sayonara Tax’ Spikes 300% Starting July 2026

- The 5 Best Debit Cards with No Foreign Transaction Fees for International Travel (2026 Guide)

- Can I Use My EBT Card in Another State? New 2026 Restrictions & Bans Explained

- Can You Fly Without Real ID in 2026? The New $45 “TSA ConfirmID” Fee Explained

- Safest Caribbean Islands in 2026: Grenada Joins Elite List as New Travel Advisories Released

- Comprehensive Travel Insurance: What’s Covered and Why It Matters 2026

- The Best Travel Insurance for 2026: Top Plans Revealed