You don’t need a six-figure income to travel the world. We break down exactly how to earn free flights with points—safely, ethically, and without ever carrying a balance. Start your journey here.

How to Earn Free Flights with Credit Card Points (Beginner’s Guide)

Imagine booking a round-trip ticket to a bucket-list destination like Paris, Tokyo, or Bali, and instead of a four-figure charge on your bank statement, you only pay a few dollars in taxes. This isn’t a dream—it is the reality for millions of people who have mastered the art of using credit card rewards for travel.

For many beginners, the world of “points” and “miles” feels like a confusing puzzle designed only for frequent business travelers. In reality, how to earn free flights with credit card points is a straightforward process that anyone with responsible financial habits can start today. Whether you are in the US, Europe, or Asia, the principles of travel hacking remain the same: spend money you were already going to spend, earn digital currency from your bank, and trade it for a seat on a plane.

In this comprehensive beginner’s guide to travel hacking, we will break down the exact steps to go from $0 in rewards to your first free flight.

1. What are Points, Miles, and Rewards?

To understand how to use credit card points for flights, you first need to know what you are collecting. Banks and airlines use these terms to reward your loyalty.

Credit Card Points

These are rewards issued directly by your bank. Think of them as a “digital currency” held within your bank account. You can often use these points to pay for travel directly through the bank’s website or, more lucratively, move them to other programs.

Airline Miles

Despite the name, “miles” usually represent a currency rather than physical distance. You earn these by flying with a specific airline or by using a credit card that is co-branded with that airline.

Flexible Rewards

These are the “gold standard” of travel hacking. Flexible rewards are points earned through a bank that can be converted into miles with many different airlines. This gives you the power to choose whichever airline has the best deal at the time.

How are they earned? Every time you swipe a rewards-earning credit card, the bank gives you a small percentage back in the form of points. For example, spending $1 might earn you 1 point. Over time, these small amounts stack up into a “free” ticket.

Amex Platinum vs. HDFC Infinia: The Definitive 2026 Comparison for Global High-Net-Worth Travelers

2. The Global Strategy: How Free Flights Work

People all over the world how to earn free flights with credit card points to see the world. Here are two common ways this happens:

- The Welcome Bonus Jumpstart: A traveler in Asia signs up for a card that offers 50,000 points after they spend $2,000 in three months. By using that card for their regular rent and utilities, they hit the goal and suddenly have enough points for a round-trip flight to Europe.

- The Daily Spender: A family in the US uses a specific card for all their grocery and dining expenses because it earns “3x points” in those categories. By the end of the year, their normal bread-and-butter spending has earned them two tickets to Hawaii.

3. The Three Types of Travel Credit Cards

To maximize your credit card rewards for travel, you need the right tool. Generally, cards fall into three categories:

General Travel Rewards Cards

These cards earn a flat rate (e.g., 2 points for every $1 spent) on everything. They are perfect for beginners who want simplicity and don’t want to track different categories.

Co-Branded Airline Credit Cards

If you live near a “hub” airport for a specific airline, these cards are great. They often come with perks like free checked bags and priority boarding, which save you cash even if you aren’t using points.

Flexible Points Programs

These allow you to move your points to 10+ different airline partners. This flexibility is the secret to getting the highest value for your points.

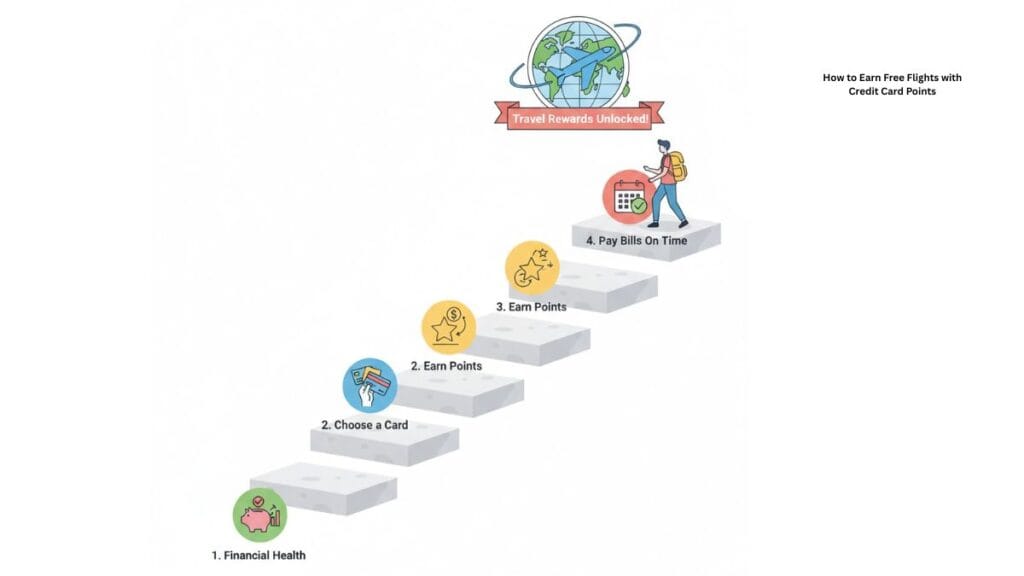

4. Beginner Roadmap: How to Start Safely

If you want to know how to use credit card points for flights, follow this roadmap:

Step 1: Check Your Credit Score

Travel cards are a “reward” for good financial behavior. Banks usually require a “Good” to “Excellent” credit score (typically 670+ in most regions). If your score isn’t there yet, focus on paying off existing debt first.

Step 2: Choose the Right Card

Don’t just pick the one with the prettiest design. Look for:

- Low Annual Fees: As a beginner, start with a card that costs less than $100/year.

- Bonus Categories: If you spend heavily on groceries, get a card that rewards that specific spend.

Step 3: Understand the Welcome Bonus

The fastest way to earn airline miles with credit cards is the “Welcome Offer.” This usually requires you to spend a specific amount (e.g., $3,000) within the first 3 months.

Crucial Tip: Only apply if you can meet this spend comfortably with your normal bills. Never overspend just for points.

Step 4: Pay in Full Every Month

This is the golden rule. Credit card interest rates are often 20%–30%. If you pay even $1 in interest, it wipes out the value of your points. Treat your credit card like a debit card—only spend what you have in your bank account.

Travel rewards are only free if you pay $0 in interest.

5. Ethical Ways to Earn Points Faster

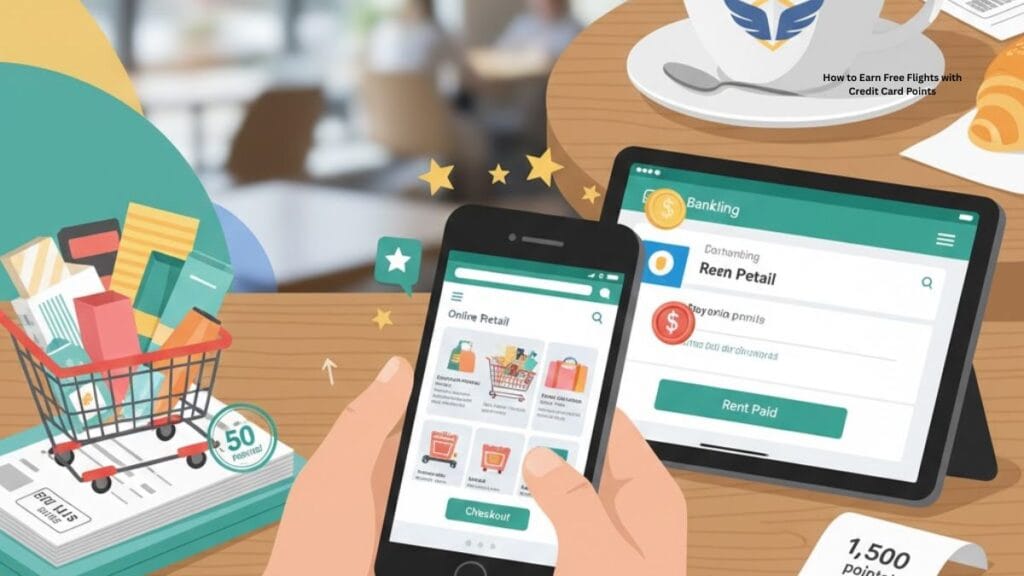

You don’t need to spend more money to get more points. You just need to be smarter about the money you already spend:

- Pay Your Rent/Utilities: Use third-party services (like Bilt or Plastiq) to pay rent.

- Online Shopping Portals: Many banks have “portals.” If you click through their link before buying clothes or electronics, you can earn 5x or 10x points for the same purchase.

- Subscriptions: Link your Netflix, Spotify, and gym memberships to your rewards card.

- Travel Portals: Booking your next hotel through your bank’s travel portal can often earn you a massive point multiplier.

6. How to Use Credit Card Points for Flights

Earning the points is only half the battle; the real magic happens when you “redeem” them.

Method 1: The Travel Portal (The “Easy” Way)

Most banks have their own travel website (similar to Expedia). You simply search for a flight and select “Pay with Points.”

- Pros: Very easy; no blackout dates.

- Cons: You usually get a fixed value (e.g., 1 cent per point), which isn’t the best deal.

Method 2: Transfer to Partners (The “Expert” Way)

This is where you get the most value. You move your points from your bank account to an airline’s frequent flyer program.

- Example: You might find a flight that costs $1,000 cash but only 40,000 miles. By transferring points, you are getting a value of 2.5 cents per point, which is excellent.

Identifying Good vs. Bad Redemptions

To calculate the value of your points, use this simple formula:

Value per Point = (Cash Price of Flight – Taxes/Fees) ÷ Number of Points Required

- Good Value: Anything over 1.5 to 2.0 cents (USD/EUR) per point.

- Bad Value: Using points to buy gift cards or electronics (usually yields less than 1 cent per point).

7. Common Mistakes to Avoid

Even smart people make mistakes when they start travel hacking. Watch out for these:

- Chasing Rewards, Not Wealth: If you go into debt to get a “free” flight, the flight isn’t free.

- Letting Points Expire: Most points stay active as long as you use your card once a year, but always check the terms.

- Ignoring Annual Fees: If a card costs $500/year but you only get $200 in value, it’s a bad deal.

- Holding Too Many Points: Points get “devalued” over time. Earn them, then use them!

8. Frequently Asked Questions (FAQs)

Can I really get completely free flights with points?

Almost. You will usually have to pay government taxes and airport fees in cash. On a domestic flight, this might be $5; on an international flight, it could be $50–$200.

Do I need a high income to start?

No. You just need a steady income that allows you to pay off your credit card bill every month. Many entry-level travel cards have very accessible income requirements.

Will this hurt my credit score?

When you apply for a card, your score may drop by a few points temporarily. However, in the long run, having more credit available and paying it off on time usually increases your credit score.

Is travel hacking legal?

Absolutely. You are simply using the marketing programs that banks and airlines have created to attract customers.

How many credit cards do I actually need?

For a beginner, just one good flexible rewards card is enough. As you get more comfortable, you might move up to two or three to maximize different spending categories.

Can I earn points on business travel?

Yes! If your company allows you to pay for travel on your personal card and reimburses you, you get to keep all the points for yourself.

What if I can’t travel right now?

Most flexible points do not expire as long as your credit card account is open. You can save them for a “dream trip” two or three years down the line.

Conclusion: Your Journey Starts with One Purchase

Learning how to earn free flights with credit card points is a marathon, not a sprint. The goal isn’t to become a millionaire; the goal is to stop leaving “free money” on the table every time you buy groceries or pay your internet bill.

Start small:

- Check your credit score.

- Research one “Entry Level” travel rewards card available in your country.

- Commit to paying the balance in full every month.

By shifting your mindset from “spending money” to “earning rewards,” the world becomes a much smaller, more affordable place. Before you know it, you’ll be sitting in that “free” seat, looking out the window, and planning your next adventure.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always research credit card products in your own country and read all terms and conditions before applying.

You can see this also:

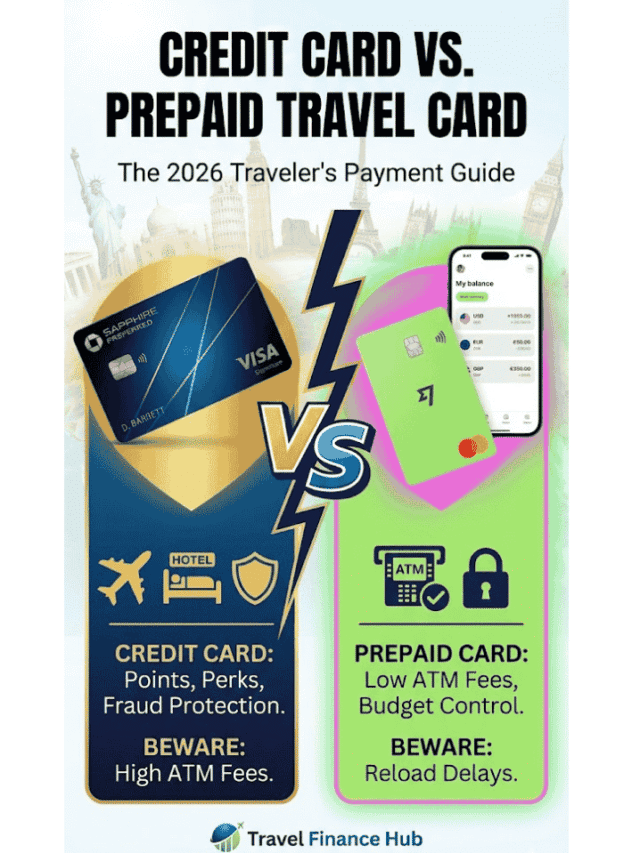

- Credit Card vs Prepaid Travel Card: What’s the Best Way to Pay Abroad in 2026?

- The End of Cheap Japan? Tourist Tax ‘Sayonara Tax’ Spikes 300% Starting July 2026

- The 5 Best Debit Cards with No Foreign Transaction Fees for International Travel (2026 Guide)

- Can I Use My EBT Card in Another State? New 2026 Restrictions & Bans Explained

- Can You Fly Without Real ID in 2026? The New $45 “TSA ConfirmID” Fee Explained

- Safest Caribbean Islands in 2026: Grenada Joins Elite List as New Travel Advisories Released

- Comprehensive Travel Insurance: What’s Covered and Why It Matters 2026

- The Best Travel Insurance for 2026: Top Plans Revealed