What comprehensive travel insurance covers — from medical emergencies to trip cancellations — and why you need it for emergency situations as a traveler. Get peace of mind today!”

Going on vacation is one of the greatest joys in life—visiting new cultures, trying exotic foods, creating memories that last a lifetime. But as thrilling as it is, travel can also be rife with uncertainty. A delayed flight, a sudden illness or lost luggage can transform a dream vacation into a nightmare with lightning speed. This is when the great thing else travel insurance comes into play — as your safety net, providing peace of thoughts and monetary safety against the unforeseen. In this article, we’ll dive deep into what comprehensive travel insurance covers, why it’s a must-have for any traveler, and how it can save you from costly mishaps.

What Is Comprehensive Travel Insurance?

At its core, comprehensive travel insurance is a robust policy designed to cover a wide range of potential travel-related issues. Unlike basic plans that might only cover flight cancellations or medical emergencies, comprehensive travel insurance offers broader protection. Think of it as an all-in-one solution that safeguards you from the moment you leave home until you return. Whether you’re a solo adventurer, a family on vacation, or a business traveler, this type of insurance is tailored to handle the unpredictable nature of travel.

But what exactly does it cover? Let’s break it down.

What’s Covered Under Comprehensive Travel Insurance?

The beauty of comprehensive travel insurance lies in its extensive coverage. While specific policies vary depending on the provider, most plans include the following key benefits:

- Trip Cancellation and Interruption

Life is unpredictable. If you need to cancel your trip due to a family emergency, illness, or even a natural disaster at your destination, comprehensive travel insurance can reimburse you for non-refundable expenses like flights, hotels, and tours. Similarly, if your trip is cut short for a covered reason, you’re protected from losing the full cost of your investment. - Medical Emergencies and Evacuation

Falling ill or getting injured abroad can be terrifying—and expensive. Comprehensive travel insurance typically covers medical expenses, including hospital stays, doctor visits, and prescription medications. In severe cases, it may also cover emergency medical evacuation, ensuring you’re transported to the nearest suitable facility or even back home if necessary. - Lost, Stolen, or Delayed Baggage

Imagine arriving at your destination only to find your luggage didn’t make it. Comprehensive travel insurance reimburses you for lost or stolen belongings and often provides funds to replace essentials if your bags are delayed for a certain period (usually 12-24 hours). - Flight Delays and Cancellations

Weather disruptions, mechanical issues, or airline strikes can throw your plans into chaos. With comprehensive travel insurance, you’re covered for additional expenses like meals, accommodations, or alternative transportation if your flight is delayed or canceled. - Accidental Death and Dismemberment

While no one likes to think about worst-case scenarios, comprehensive travel insurance often includes coverage for accidental death or serious injury during your trip. This provides financial support to you or your loved ones in tragic circumstances. - Rental Car Damage

Renting a car to explore your destination? Many comprehensive travel insurance plans cover damage to rental vehicles, saving you from hefty repair bills or liability claims. - 24/7 Travel Assistance

Beyond financial protection, comprehensive travel insurance often includes round-the-clock assistance services. Need help finding a doctor abroad, rebooking a flight, or replacing a lost passport? A quick call to your insurer can get you back on track.

These are just the highlights. Some policies even extend to niche scenarios like trip delays due to terrorism, coverage for pre-existing medical conditions (with certain conditions), or cancellations due to work emergencies. The key is to read the fine print and choose a plan that aligns with your travel needs.

Why Comprehensive Travel Insurance Matters

You might be wondering, “Do I really need comprehensive travel insurance? Can’t I just wing it?” While it’s tempting to skip the extra cost, the reality is that travel is full of variables you can’t control. Here’s why investing in this coverage is a smart move:

- Financial Security

Travel isn’t cheap. Between flights, accommodations, and activities, a single trip can cost thousands of dollars. If something goes wrong—like a canceled flight or a medical emergency—comprehensive travel insurance ensures you’re not left footing the bill. For example, emergency medical evacuation alone can cost upwards of $50,000 without insurance. - Peace of Mind

There’s something invaluable about knowing you’re covered no matter what happens. With comprehensive travel insurance, you can focus on enjoying your trip instead of worrying about “what ifs.” Whether it’s a sprained ankle in Paris or a missed connection in Tokyo, you’ve got a safety net. - Protection Against the Unexpected

From natural disasters to political unrest, global events can disrupt even the best-laid plans. Comprehensive travel insurance offers flexibility and support when the unexpected strikes, allowing you to adapt without breaking the bank. - Legal and Liability Coverage

If you accidentally cause damage or injury while traveling—like crashing a rental scooter—some policies include liability coverage to protect you from legal headaches.

In short, comprehensive travel insurance isn’t just a luxury—it’s a practical tool that mitigates risk and enhances your travel experience.

How to Choose the Right Travel Insurance Plan

Not all comprehensive travel insurance policies are created equal. To get the most value, consider these factors when shopping around:

- Coverage Limits

Check the maximum payout for each benefit. For instance, does the medical coverage cap at $50,000 or $500,000? Ensure the limits match your destination’s healthcare costs and your trip’s overall value. - Exclusions

Every policy has exclusions—situations it won’t cover. Common ones include injuries from extreme sports (unless you add a rider), pre-existing conditions without a waiver, or cancellations for reasons not listed in the policy. Read the terms carefully. - Deductibles and Premiums

A lower premium might mean a higher deductible (the amount you pay out of pocket before coverage kicks in). Balance affordability with the level of protection you need. - Provider Reputation

Look for insurers with strong customer reviews and a track record of paying claims promptly. Companies like Allianz, World Nomads, and Travelex are often praised for their travel insurance offerings. - Trip-Specific Needs

Heading to a remote area? Make sure evacuation coverage is robust. Traveling with expensive gear? Confirm the baggage loss limit is sufficient. Tailor the policy to your itinerary.

Real-Life Scenarios: When Comprehensive Travel Insurance Saves the Day

Still on the fence? Let’s look at a few real-world examples where comprehensive travel insurance proved its worth:

- Scenario 1: Medical Emergency Abroad

Sarah, a 32-year-old from Chicago, was hiking in Peru when she broke her leg. Her comprehensive travel insurance covered her $12,000 hospital bill, arranged her evacuation to a better-equipped facility, and even paid for her flight home once she was stable. Without it, she’d have faced a crippling debt. - Scenario 2: Trip Cancellation

Mark and his family planned a $5,000 Caribbean cruise, but a hurricane forced them to cancel. Thanks to their comprehensive travel insurance, they received a full refund for the non-refundable deposit, sparing them a major financial loss. - Scenario 3: Lost Luggage

On a business trip to London, Priya’s suitcase—with her laptop and presentation materials—went missing. Her comprehensive travel insurance reimbursed her $1,500 for replacements and covered the cost of new clothes while she waited for her bag to (hopefully) turn up.

These stories highlight how comprehensive travel insurance can turn a disaster into a minor inconvenience.

Common Myths About Comprehensive Travel Insurance

Despite its benefits, misconceptions about comprehensive travel insurance persist. Let’s debunk a few:

- Myth 1: It’s Too Expensive

In reality, comprehensive travel insurance typically costs 4-10% of your trip’s total value—pennies compared to the potential losses it prevents. - Myth 2: My Credit Card Covers Everything

While some credit cards offer basic travel protections, they rarely match the breadth of comprehensive travel insurance. Medical coverage, in particular, is often absent. - Myth 3: I Don’t Need It for Short Trips

Even a weekend getaway can go awry. A delayed flight or stolen phone can happen anywhere, anytime.

Final Thoughts: Don’t Travel Without It

In today’s unpredictable world, comprehensive travel insurance is more than just a nice-to-have—it’s a necessity. It’s the difference between a ruined trip and a recoverable hiccup, between financial strain and stability. Whether you’re jetting off to a tropical paradise or embarking on a cross-country road trip, this coverage ensures you’re prepared for whatever comes your way.

So, before you pack your bags, take a moment to research and invest in a comprehensive travel insurance plan. It’s a small price to pay for the confidence that comes with knowing you’re covered. After all, travel is about adventure, not anxiety—and with the right insurance, you can embrace every moment without looking over your shoulder. Wikipedia

FAQs About Comprehensive Travel Insurance

1. What does comprehensive travel insurance typically cost?

The cost varies based on factors like trip duration, destination, and coverage limits, but it usually ranges from 4-10% of your total trip cost. For a $2,000 trip, that’s $80-$200—a small price for extensive protection.

Does comprehensive travel insurance cover pre-existing conditions?

Some plans do, but only if you meet specific requirements, like purchasing the policy within a certain timeframe (e.g., 14 days of booking your trip) and securing a waiver. Always check the policy details.

Can I get comprehensive travel insurance for international trips only?

No! It’s available for both domestic and international travel. Even a road trip within your home country can benefit from coverage for cancellations, medical emergencies, or rental car damage.

What’s the difference between comprehensive travel insurance and basic plans?

Basic plans might cover just one or two things—like trip cancellation or medical expenses—while comprehensive travel insurance bundles multiple protections into one policy, offering broader security.

How do I file a claim with comprehensive travel insurance?

Most insurers provide a simple process: submit a claim form (online or by mail) with supporting documents like receipts, medical records, or airline correspondence. Contact your provider’s 24/7 helpline for guidance.

Is comprehensive travel insurance worth it for adventure travel?

Absolutely. If you’re skiing, scuba diving, or hiking, look for a policy with optional riders for high-risk activities. Standard plans might exclude these, so customization is key

You can see this also:

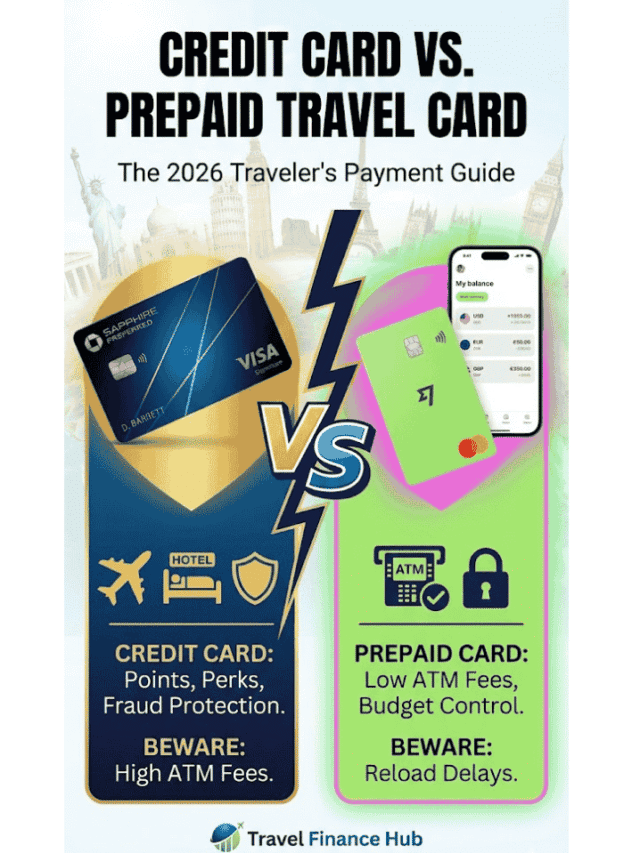

- Credit Card vs Prepaid Travel Card: What’s the Best Way to Pay Abroad in 2026?

- The End of Cheap Japan? Tourist Tax ‘Sayonara Tax’ Spikes 300% Starting July 2026

- The 5 Best Debit Cards with No Foreign Transaction Fees for International Travel (2026 Guide)

- Can I Use My EBT Card in Another State? New 2026 Restrictions & Bans Explained

- Can You Fly Without Real ID in 2026? The New $45 “TSA ConfirmID” Fee Explained

- Safest Caribbean Islands in 2026: Grenada Joins Elite List as New Travel Advisories Released

- Comprehensive Travel Insurance: What’s Covered and Why It Matters 2026

- The Best Travel Insurance for 2026: Top Plans Revealed