Amex Platinum vs. HDFC Infinia (2026): Which premium card wins for global travelers? Compare fees, 10X rewards, lounge access, and exclusive lifestyle perks. Learn how to maximize your points in the USA and globally to ensure your metal card pays for itself.

In the rapidly evolving landscape of 2026, the battle for the premier spot in a high-net-worth individual’s wallet has narrowed down to two titans: Amex Platinum vs. HDFC Infinia. For the global citizen—whether you are based in the USA, navigating the business hubs of London, or managing assets in Dubai—choosing between the American Express Platinum Card and the HDFC Bank Infinia Metal Edition is no longer just about interest rates. It is about lifestyle engineering.

The year 2026 has brought significant shifts in how we value travel and luxury. With premium travel demand at an all-time high and loyalty programs becoming more consolidated, the “best” card is the one that offers the most fluid utility across borders. This article provides an exhaustive, deep-dive comparison to help you decide which metal masterpiece deserves your loyalty.

What is the Amex Platinum vs. HDFC Infinia Debate?

At their core, both cards represent the “Super-Premium” tier of consumer credit. However, they approach luxury from different philosophies:

- The American Express Platinum Card is often viewed as a “lifestyle concierge in your pocket.” Its value is front-loaded into status, immediate perks, and a massive network of global lounges.

- The HDFC Infinia (Metal Edition) is the “efficiency king.” It is designed for the mathematically inclined spender who wants the highest possible “value-back” on every dollar (or rupee) spent, specifically through its legendary reward multipliers.

For a USA-based user, the Amex Platinum is a domestic staple with global reach. For a global English-speaking audience, particularly those with ties to South Asia or the Middle East, the HDFC Infinia has emerged as a formidable rival that often outpaces Amex in pure reward ROI.

Why the Amex Platinum vs. HDFC Infinia Comparison Matters in 2026

Why are we comparing these two specifically in 2026? Three reasons:

- Global Transferability: As of 2026, both cards have expanded their airline and hotel transfer partners. Your points are now a “global currency” that can be moved into Marriott Bonvoy, Singapore Airlines KrisFlyer, or British Airways Executive Club.

- Fee Justification: With annual fees on premium cards rising (Amex Platinum now sits at $695 USD in the US, while Infinia remains around $150 USD plus taxes), users are scrutinizing “net-zero” value—how easily the perks cover the cost.

- Lounge Crowding: In 2026, lounge access is a premium commodity. Amex has restricted guest access in many regions, while Infinia still offers some of the most generous guest policies for international travelers.

Master Travel Hacking: How to Earn Free Flights Using Points

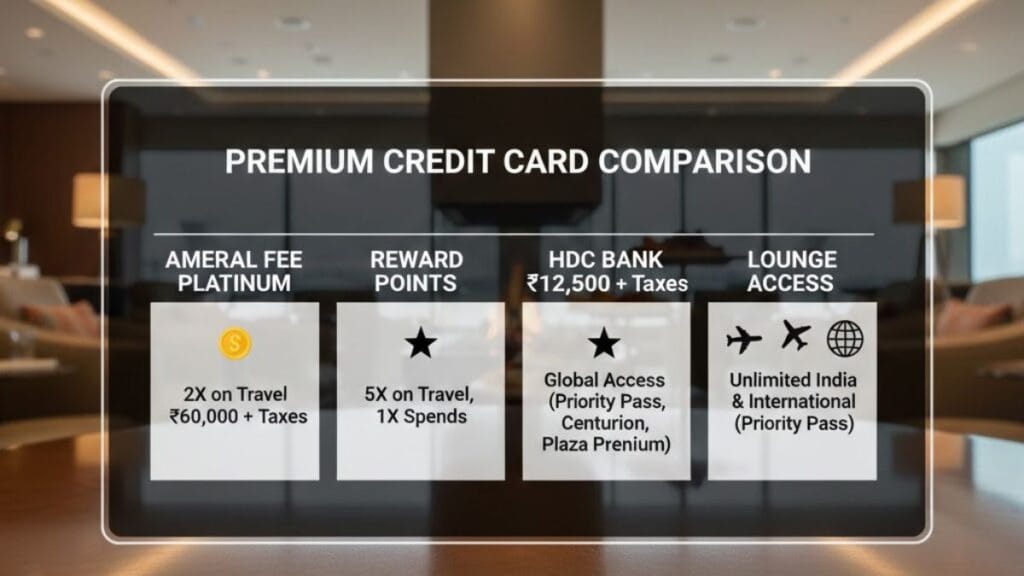

Benefits Analysis: Side-by-Side Comparison

When looking at Amex Platinum vs. HDFC Infinia, the numbers tell the story. Let’s break down the core benefits in equivalent USD values for easy global comparison.

1. Reward Rates and Earning Potential

The earning structure is where these two cards diverge most sharply.

| Category | Amex Platinum (USA) | HDFC Infinia (Global/India) |

| Base Earn Rate | 1 Point per $1 spent | ~3.3% Value-back ($1 per $30 spent) |

| Travel Booking | 5X Points on Flights/Hotels | 10X Points (up to 33% value) via SmartBuy |

| Point Value | ~1.0 to 2.0 cents (Travel) | Fixed at 1.0 (approx. $0.012 USD) |

| Transfer Ratio | 1:1 (Most Partners) | 1:1 (Most Partners) |

2. Travel and Lifestyle Perks

Amex wins on “Status,” but Infinia wins on “Access.”

- Amex Platinum: Offers Marriott Bonvoy Gold, Hilton Honors Gold, and Hertz President’s Circle. These are “earned” status levels that usually require 20+ nights of stays.

- HDFC Infinia: Offers unlimited lounge access for both the primary cardholder and the add-on member. In 2026, the ability to bring a spouse into a lounge for free is a high-value perk that Amex now charges for in many jurisdictions.

Step-by-Step Guide: How to Choose Your Card

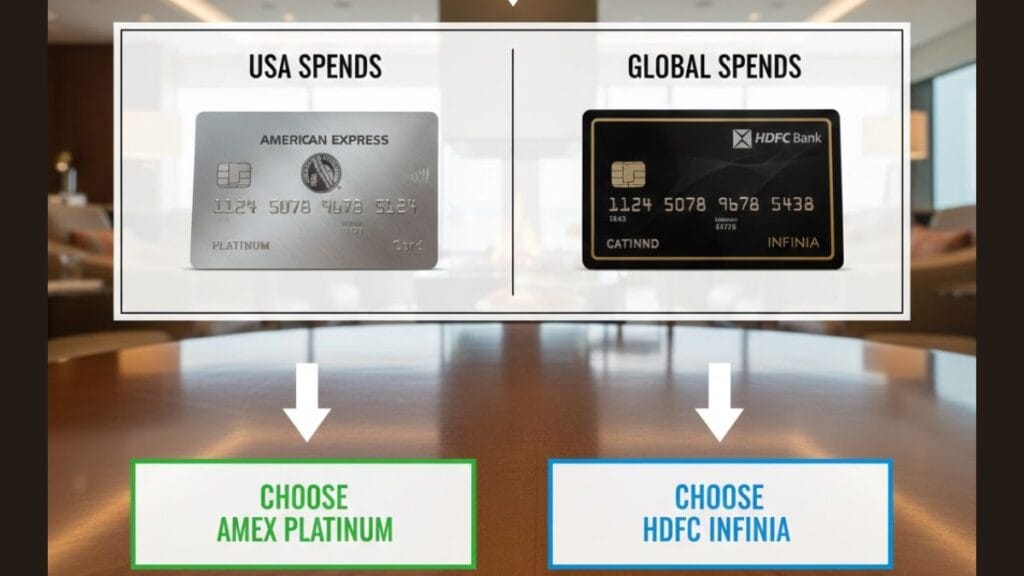

If you are a global user deciding between Amex Platinum vs. HDFC Infinia, follow this logic:

Step 1: Analyze Your Primary Spend Location

If 80% of your spending is within the USA, the Amex Platinum is non-negotiable due to the localized “credits” (Digital Entertainment, Uber, Walmart+). If you are a global nomad or based in India/UAE, the Infinia’s lower forex markup (2% vs Amex’s ~3.5%) makes it the superior choice for international swipes.

Step 2: Evaluate Your Redemption Style

- The “Hacker”: If you enjoy finding the perfect “sweet spot” in airline transfer charts to book a $10,000 First Class seat for 80,000 points, Amex Platinum is your tool.

- The “Pragmatist”: If you want to log into a portal, see a flight for $500, and pay for it exactly with 40,000 points without thinking about “availability,” HDFC Infinia is better.

Step 3: Calculate the “Net Fee”

- Amex: $695 fee – $200 Hotel Credit – $200 Airline Credit – $200 Uber Credit = $95 Net Fee.

- Infinia: ~$150 fee – $150 worth of Welcome Points = $0 Net Fee.

Real-Life Examples: Value in Action

Scenario A: The New York Executive (Amex Platinum)

John spends $50,000 a year on business travel. By using his Amex Platinum, he earns 250,000 points. He uses the Centurion Lounge in JFK twice a month (Value: $1,200/year). He transfers points to Virgin Atlantic for a London trip, getting 3 cents per point.

Total Value Realized: ~$8,000 USD.

Scenario B: The Dubai/Singapore Consultant (HDFC Infinia)

Sarah spends the equivalent of $50,000 USD on her Infinia. By booking her flights through the SmartBuy portal (10X rewards), she earns enough points to fund her entire family’s year-end vacation to the Maldives for free. She also saves $750 in forex fees compared to using a standard card.

Total Value Realized: ~$6,500 USD.

Pro Tips for Maximizing Your Metal Card

- The “Add-on” Strategy: For HDFC Infinia, always get the add-on cards for your family. They get their own Priority Pass, which is a massive saver on international family trips.

- The Retention Call: In 2026, card issuers are desperate to keep high spenders. Before your Amex Platinum renewal, call and ask for a “retention offer.” It is common to receive 30,000 to 50,000 points just for staying.

- Use the Concierge for Hard-to-Get Tables: Both cards offer “Global Concierge” services. In 2026, these teams have better access to Michelin-starred reservations in Tokyo and Paris than most online apps.

Common Mistakes to Avoid

- Ignoring the Forex Markup: Many users see “3X rewards on international spend” on the Amex Platinum and forget they are paying a 3.5% markup. You are often just “buying” points at a high price.

- Losing Points to Expiry: Amex points never expire. HDFC Infinia points expire after 3 years. Do not hoard Infinia points; use them.

- Forgetting the “Credits”: The Amex Platinum is only worth it if you use the “coupon book” of credits. If you don’t use Uber or Disney+, you are overpaying for the card.

Frequently Asked Questions (FAQs)

Which card is better for airport lounge access in 2026?

HDFC Infinia is generally better for families because it offers unlimited access for both the primary and add-on cardholders. Amex Platinum has a larger network (Centurion, Delta SkyClub, Escape) but has stricter guest policies.

Is the Amex Platinum vs. HDFC Infinia comparison valid for US residents?

Yes, many US-based NRIs or global expats hold both. The Amex Platinum is used for US domestic spending, while the Infinia is used for travel to Asia or for its high reward rate on global portals.

What is the minimum income for HDFC Infinia in 2026?

Typically, HDFC requires a monthly post-tax income of ~$3,500 USD (or equivalent) or a significant banking relationship (Imperia/Private Banking status).

Can I transfer HDFC points to US-based airlines?

Yes, HDFC points can be transferred to Singapore Airlines, United (via partners), and British Airways, which are highly useful for US domestic or Trans-Atlantic flights.

Does Amex Platinum still offer a $200 hotel credit?

As of 2026, the $200 Fine Hotels + Resorts (FHR) credit remains a staple of the US Amex Platinum, often providing over $500 in total value including breakfast and late checkout.

Which card has a better metal feel?

The HDFC Infinia Metal is widely regarded as one of the heaviest and most premium-feeling cards globally, often surprising users who expect Amex to lead in card aesthetics.

Is the forex markup really a dealbreaker?

The HDFC Infinia Metal is widely regarded as one of the heaviest and most premium-feeling cards globally, often surprising users who expect Amex to lead in card aesthetics.

Can I use Amex points for cashback?

You can, but it is a “mistake.” Redemption for cashback usually yields 0.6 cents per point, whereas travel redemption can yield 2.0 cents or more.

Which card is easier to get?

Amex Platinum is generally easier to get if you have a high credit score (740+ in the USA). HDFC Infinia is “invite-only” or requires a strict existing relationship with HDFC Bank.

Does Infinia offer Marriott Gold status?

No. This is a unique advantage of the Amex Platinum. Infinia offers hotel vouchers and Club Marriott memberships, but not the “automatic” elite status that Amex provides.

Conclusion: The Final Verdict for 2026

The winner of the Amex Platinum vs. HDFC Infinia showdown depends entirely on your lifestyle “DNA.”

- Choose Amex Platinum if you value the experience. You want the Centurion Lounge, you want the hotel upgrades, and you want the peace of mind that comes with American Express’s legendary customer service and purchase protection.

- Choose HDFC Infinia if you value the math. You want the highest possible return on your spending, you travel frequently across different currencies, and you want a card that effectively “pays for itself” through its massive 10X reward multipliers.

In 2026, the smartest global citizens are often not choosing one—they are carrying both. They use the Amex for its protection and status, and the Infinia for its unrivaled earning power.

Disclaimer

Note: This article is for informational purposes only and does not constitute financial advice. Credit card terms, fees, and reward structures are subject to change by the issuers (American Express and HDFC Bank). Always review the latest official cardmember agreements before applying.

You can see this also:

- Credit Card vs Prepaid Travel Card: What’s the Best Way to Pay Abroad in 2026?

- The End of Cheap Japan? Tourist Tax ‘Sayonara Tax’ Spikes 300% Starting July 2026

- The 5 Best Debit Cards with No Foreign Transaction Fees for International Travel (2026 Guide)

- Can I Use My EBT Card in Another State? New 2026 Restrictions & Bans Explained

- Can You Fly Without Real ID in 2026? The New $45 “TSA ConfirmID” Fee Explained

- Safest Caribbean Islands in 2026: Grenada Joins Elite List as New Travel Advisories Released

- Comprehensive Travel Insurance: What’s Covered and Why It Matters 2026

- The Best Travel Insurance for 2026: Top Plans Revealed