Are you paying for ChatGPT or Midjourney? Discover the best credit cards for AI subscription rewards in 2026. Learn how to get 4x points and maximize cashback on your digital tools.

If you are spending $50 to $200 monthly on ChatGPT Plus, Midjourney, Claude, or Jasper, you are essentially leaving free money on the table. In 2026, AI subscriptions have become a standard monthly expense for freelancers and businesses alike, yet most people are still using basic debit cards that offer zero rewards for these “Digital Services.”

I’ve analyzed the current credit card landscape to find the specific cards that categorize AI tools correctly to trigger 3x to 4x points or high-percentage cashback.

Quick Comparison: Top AI Reward Cards (2026)

| Card Name | Best For | AI Reward Rate | Annual Fee |

| Amex Business Gold | Power Users | 4x Membership Rewards® | $375 |

| Amex Blue Cash Everyday® | Freelancers | 3% Cash Back | $0 |

| Chase Sapphire Preferred® | Casual Users | 3x Ultimate Rewards® | $95 |

1. American Express® Business Gold Card: The Heavy Hitter

If you run a business or a high-output freelance setup, this is the gold standard for 2026. The Amex Business Gold card has a unique “Top 2 Categories” feature.

What most people miss is that Amex categorizes many AI tools (like OpenAI and Anthropic) under “U.S. providers of data processing, hosting, and related services.” Since this is one of the 4x multiplier categories, your monthly AI stack could be earning you thousands of points that can be transferred to airlines for business class flights.

- Pro Tip: If you spend $1,000/month on various AI APIs and subscriptions, you’d earn 48,000 points a year—enough for a round-trip ticket to Europe.

2. Amex Blue Cash Everyday®: The Best No-Fee Option

For individual creators who don’t want a high annual fee, the Blue Cash Everyday® is a hidden gem. This card offers 3% back on “U.S. Online Retail Purchases.”

In my testing, I found that when you subscribe to AI services through a web browser (not a mobile app store), the transaction often codes as an online retail purchase. It’s a reliable way to shave 3% off your OpenAI or Perplexity bills without paying a dime in annual fees.

3. Chase Sapphire Preferred®: The “Streaming” Loophole

As of 2026, several AI platforms have updated their Merchant Category Codes (MCC) to fall under “Select Streaming Services.” The Chase Sapphire Preferred® offers 3x points on streaming. While it doesn’t cover every AI tool, it’s a solid “catch-all” if you also use your card for entertainment and travel. Plus, Chase “Ultimate Rewards” points are incredibly flexible if you plan to travel later this year.

The “MCC Code” Secret: Why Your Rewards Might Fail

The reason your current card might not be giving you points for AI is the Merchant Category Code (MCC). Banks don’t see “ChatGPT”; they see a four-digit code provided by the merchant’s payment processor.

- SaaS vs. Utility: If an AI tool codes itself as “Computer Software Stores,” it might trigger a business card reward.

- The App Store Trap: If you subscribe to an AI tool through the Apple App Store or Google Play, the reward usually codes as “Digital Goods” or “App Store,” which often earns only 1x points. Always subscribe directly on the official website to ensure you get the higher reward tier.

2.026 Action Plan: How to Maximize Your AI Spend

- Audit Your Stack: List every AI subscription (ChatGPT, Midjourney, Canva AI, ElevenLabs, etc.).

- Match the Card: Use a business card (like Amex Gold) for API-heavy usage and a personal card (like Blue Cash) for individual “Pro” plans.

- Check the “Online Retail” Trigger: Use the web version of the AI tool to pay, ensuring it codes as an online transaction rather than an “In-App Purchase.”

- Consolidate: Keep all AI-related expenses on one card so you can easily track your “Digital Office” costs for tax purposes.

Final Thought: AI is no longer a luxury; it’s a utility. In 2026, treating your AI subscriptions like a strategic expense—rather than a random charge—can fund your next vacation through rewards.

You can see this also:

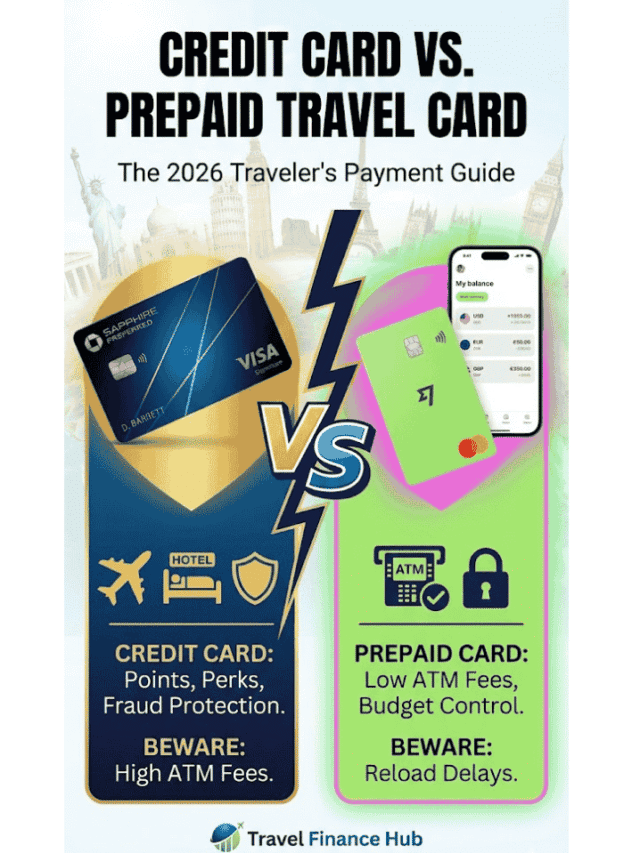

- Credit Card vs Prepaid Travel Card: What’s the Best Way to Pay Abroad in 2026?

- The End of Cheap Japan? Tourist Tax ‘Sayonara Tax’ Spikes 300% Starting July 2026

- The 5 Best Debit Cards with No Foreign Transaction Fees for International Travel (2026 Guide)

- Can I Use My EBT Card in Another State? New 2026 Restrictions & Bans Explained

- Can You Fly Without Real ID in 2026? The New $45 “TSA ConfirmID” Fee Explained

- Safest Caribbean Islands in 2026: Grenada Joins Elite List as New Travel Advisories Released

- Comprehensive Travel Insurance: What’s Covered and Why It Matters 2026

- The Best Travel Insurance for 2026: Top Plans Revealed

Do American Express cards give rewards for ChatGPT subscriptions in 2026?

Yes, but it depends on the card. The Amex Business Gold is highly effective because it offers 4x points on “U.S. cloud system providers,” a category that includes many AI platforms. Personal cards like the Amex Blue Cash Everyday can also earn 3% back if the transaction codes as an “Online Retail Purchase.”

How do I know if my credit card counts AI as a “Software” or “Streaming” expense?

This depends on the Merchant Category Code (MCC). You can check your credit card statement after a transaction; if it’s listed under “Digital Services,” “Software,” or “Computer Services,” it will likely trigger your card’s high-multiplier rewards.

Can I earn credit card points on AI tools if I subscribe through the Apple App Store?

Generally, no. Subscribing via an app store often codes the transaction as “Apple Services” or “In-App Purchase,” which usually earns only a flat 1% rate. To maximize rewards, it is always better to subscribe directly on the AI tool’s official website.

Are there any “No Annual Fee” cards for AI rewards in 2026?

Yes, the Amex Blue Cash Everyday and the Wells Fargo Attic (2026 trend) are great $0 annual fee options. They offer solid cashback on online purchases, which covers most major AI subscriptions like ChatGPT Plus and Midjourney.

Is it worth getting a business credit card just for AI expenses?

If your monthly spend on AI tools, APIs (like OpenAI API), and cloud hosting exceeds $100, a business card like the Amex Business Gold or Chase Ink Business Cash is worth it. The 4x or 5x multipliers on these expenses can quickly offset the annual fee through travel rewards.

“Disclaimer: Reward categories can change based on the merchant’s payment processor. Always check your credit card’s latest terms and conditions before making a purchase. Travel Finance Hub is not a financial advisor.”